As the cannabis industry continues to grow, entrepreneurs in this field are facing a complex array of tax regulations. Navigating these regulations can be daunting, but with careful planning and a clear understanding of the rules, you can steer your business towards a successful future. In this practical guide, we’ll break down the key aspects of cannabis tax regulations that every cannabis business owner should know.

Understanding Federal and State Tax Obligations

The first step to navigating cannabis tax regulations is understanding the differences between federal and state tax obligations. Although cannabis remains a controlled substance at the federal level, states where cannabis is legal have their own tax regulations. It is crucial to consult with a tax professional who is familiar with both federal and state tax codes to ensure compliance.

Section 280E: What You Need to Know

One of the most significant federal tax challenges facing cannabis businesses is Section 280E of the Internal Revenue Code. This provision prohibits businesses from deducting normal business expenses if they are associated with trafficking controlled substances, which includes cannabis. This can result in a higher effective tax rate for your business.

Strategies for Mitigating 280E Impact

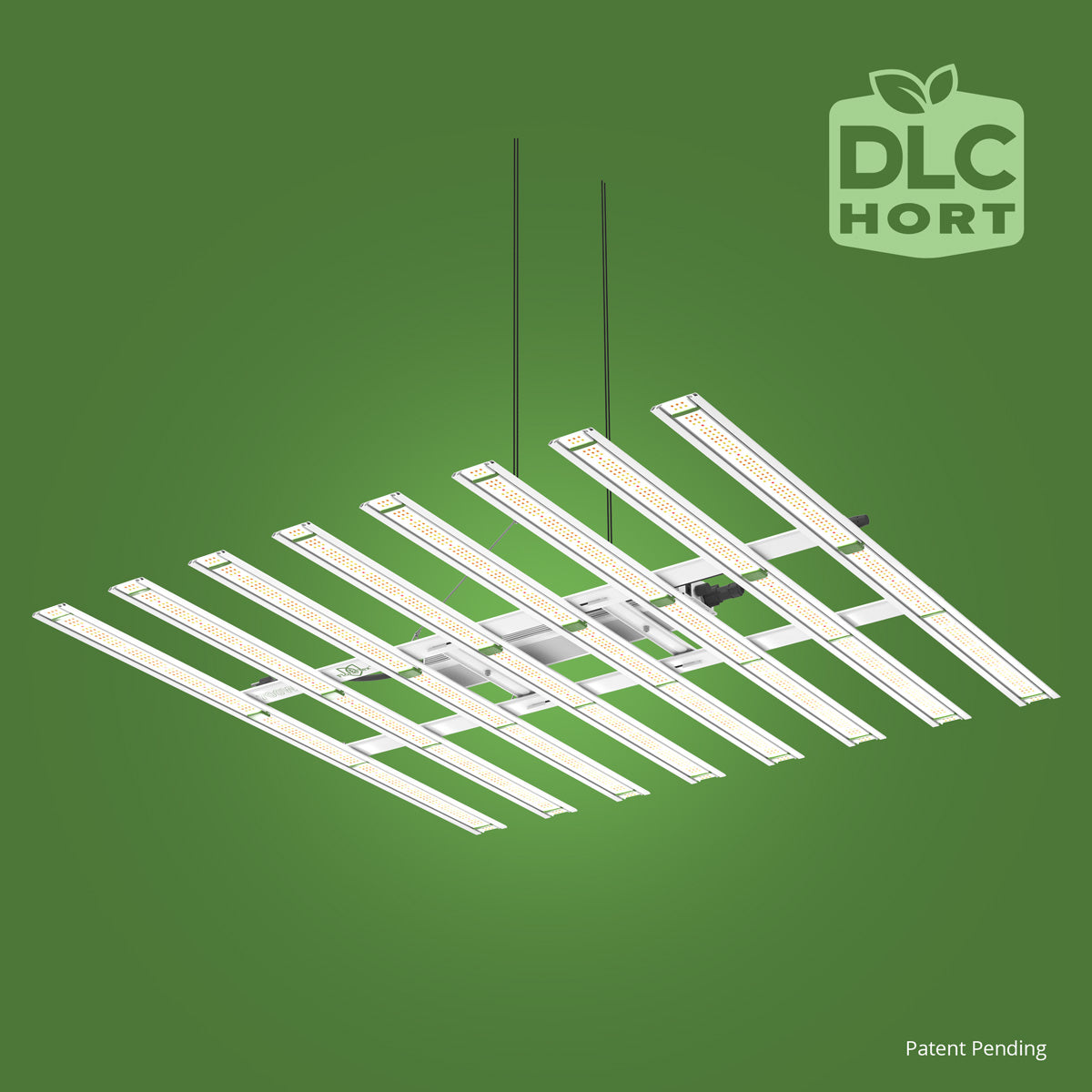

To mitigate the impact of Section 280E, cannabis businesses should focus on cost of goods sold (COGS) deductions. Properly documenting and maximizing COGS can help reduce taxable income. Consider investing in reliable Submersible Pumps or Buffered 50L LooseFill™ 70/30 Coco + Perlite for efficient cultivation processes that contribute to your COGS.

State-Level Taxes and Compliance

Each state imposes its own cannabis-specific taxes, which can include excise, cultivation, sales, or other types of taxes. It’s essential to familiarize yourself with the specific tax obligations in your state to avoid penalties and ensure smooth operations.

Leveraging Cannabis Cultivation Tools

State compliance can often be streamlined with the right cultivation tools. For example, using Commercial Trellis Nets can support efficient plant growth and maximize yield, which in turn can improve your tax reporting and compliance.

Conclusion

Effectively navigating cannabis tax regulations requires a deep understanding of both federal and state tax laws. Educating yourself about these regulations and working with experienced tax professionals are pivotal steps in managing your cannabis business successfully.

As you plan your cultivation and financial strategies, consider visiting FloraFlex’s website for innovative cultivation tools and products that support efficient and compliant operations. Explore more at FloraFlex and arm yourself with the resources for a thriving business.

This practical guide is the starting point for understanding the intricate web of cannabis tax regulations. Stay informed and proactive to ensure that your cannabis business not only survives but thrives in this burgeoning industry.